PERSONALIZED GOAL-DRIVEN

ONBOARDING

Guiding new users to their credit goals with personalized onboarding

PROJECT OVERVIEW

My Role: Design Manager

Timeline: June 2025 - October 2025

Team:

2 Designers

3 Developers (iOD, AND, Web)

1 Product Manager

1 Content Writer

Tools:

Figma

Headless CMS (ContentStack)

Lottie animation

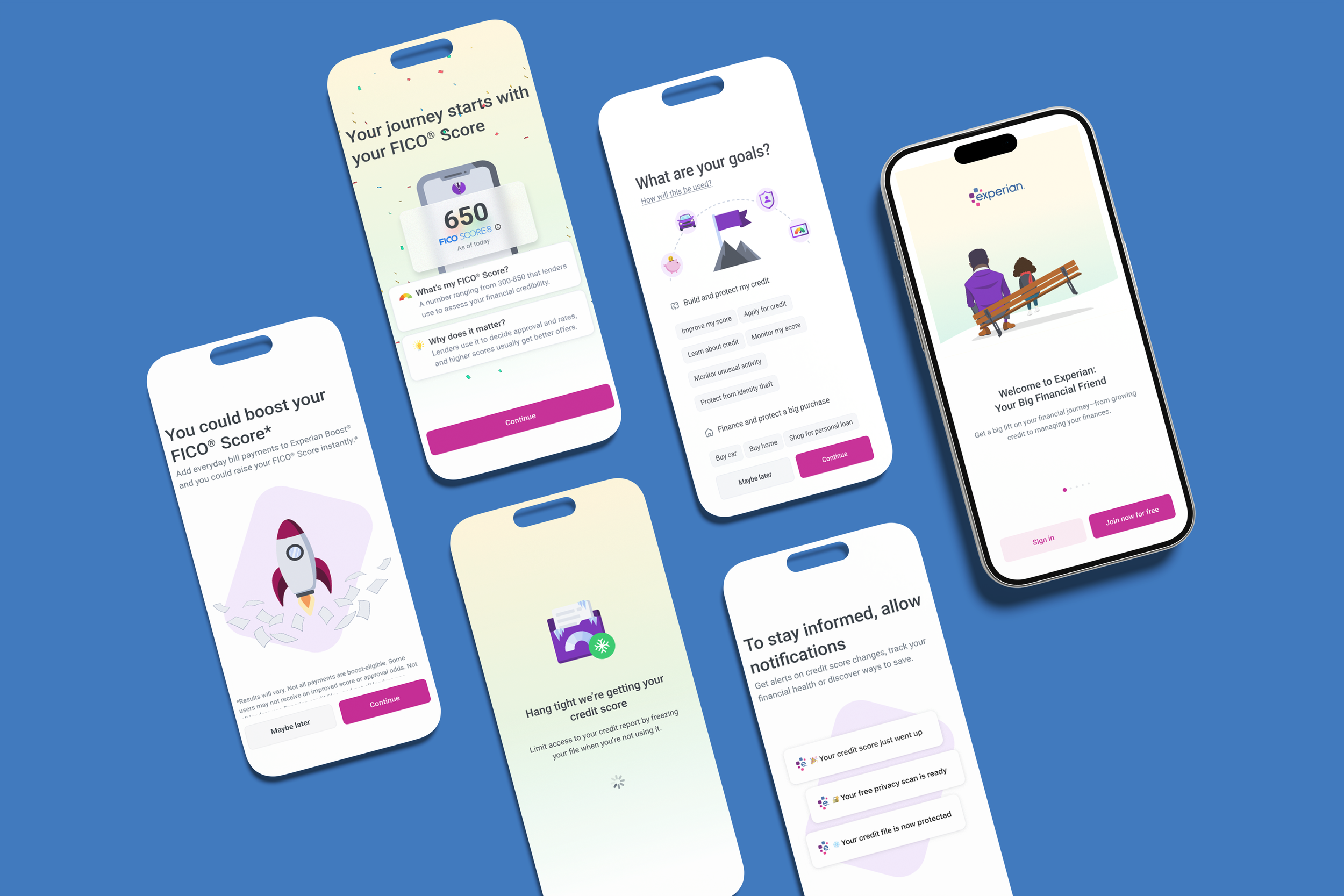

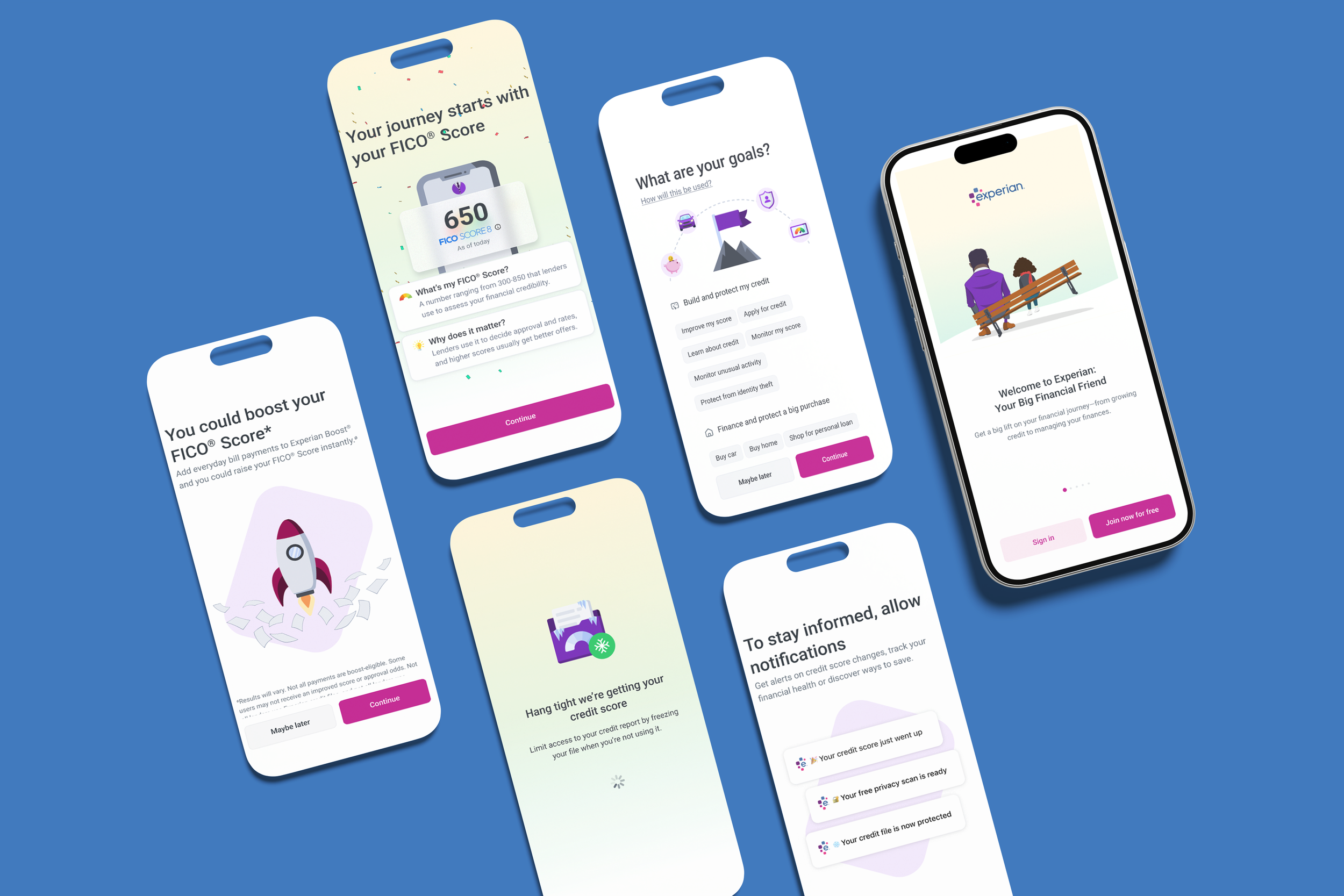

The Challenge: Credit and finances can be confusing. Any new users of Experian’s direct to consumer website and app were essentially dropped off without any assistance when creating a new account. We wanted to practice what we preach and become a financial friend to all, knowing our customer’s goals from the very beginning of our relationship.

My role in this project was guiding the design, content and visual experience teams to create a cohesive, goal-led onboarding experience for new users that was scalable and customizable across 50+ potential goals selected by users. The experience was built using reusable content models and design components.

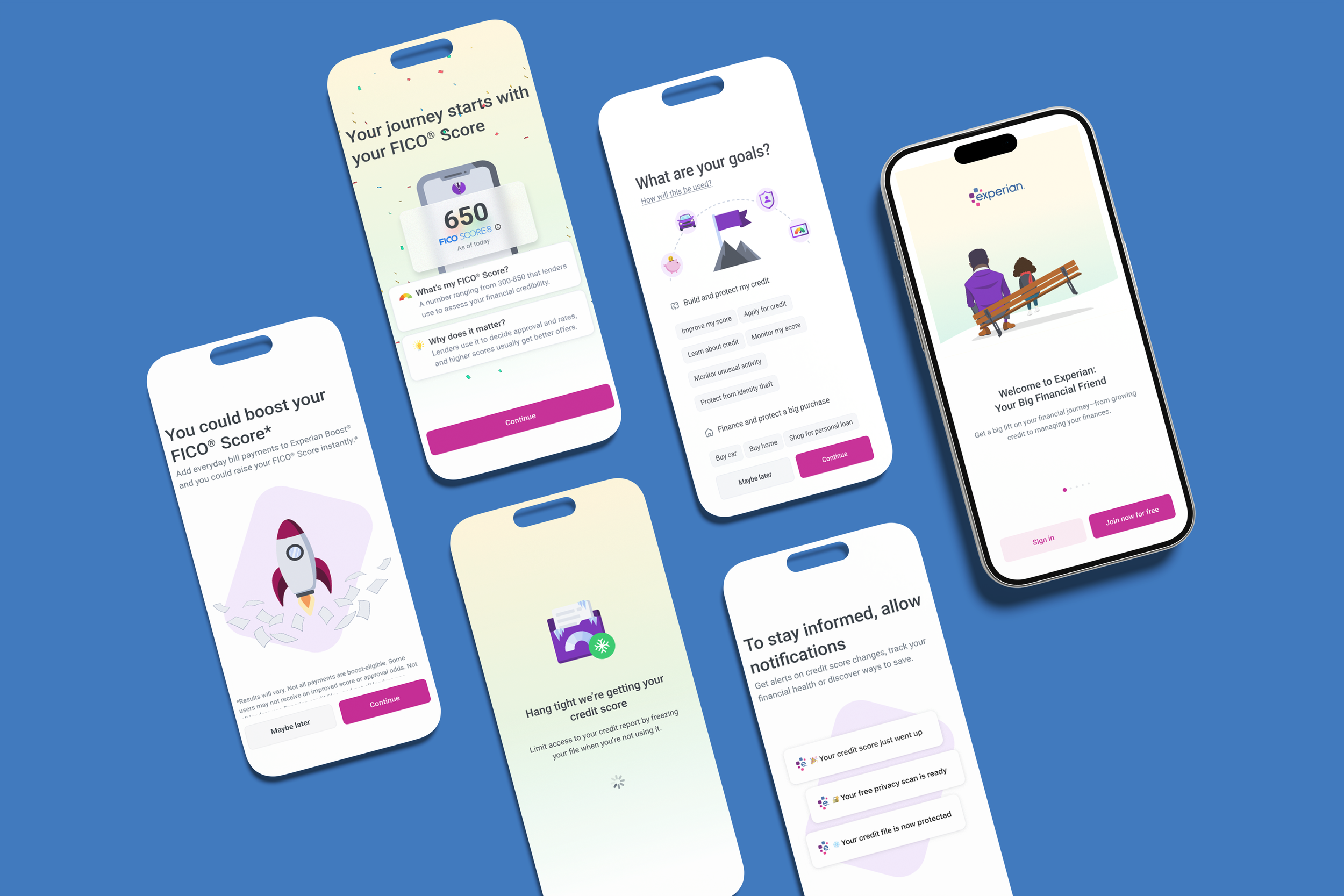

The Outcome: Launched a redesigned onboarding flow that increased user engagement by 50%, increased revenue per user by 47%, and improved task completion rates from 48% to 72%. The onboarding flow is created in 4 distinct templates that can be reworked for any intent or goal the user sets–from building credit to reducing debt.

PERSONALIZED GOAL-DRIVEN ONBOARDING

THE PROCESS

RESEARCH & DISCOVERY

UNDERSTANDING THE PROBLEM

We used existing metrics to understand drop off rates in app, when and how users return to their accounts after creating them, and qualitative feedback from our Voice of Customer initiatives, along with testing the complete new flow with users via moderated usability testing.

We discovered users want more help when setting up their account. Credit is confusing for most, and new for many who come to us for help. Users expect instant value from their memberships, and need to be guided to their best first move.

PERSONALIZED GOAL-DRIVEN ONBOARDING

IDEATION & EXPLORATION

EXPLORING SOLUTIONS

With a desire to release this and test within 1 quarter, we focused on our most common user goals: manage debt and improve my credit, launching those flows first and following with a more robust catering to user goals such as buying cars and homes, refinancing, searching for financial products, and more.

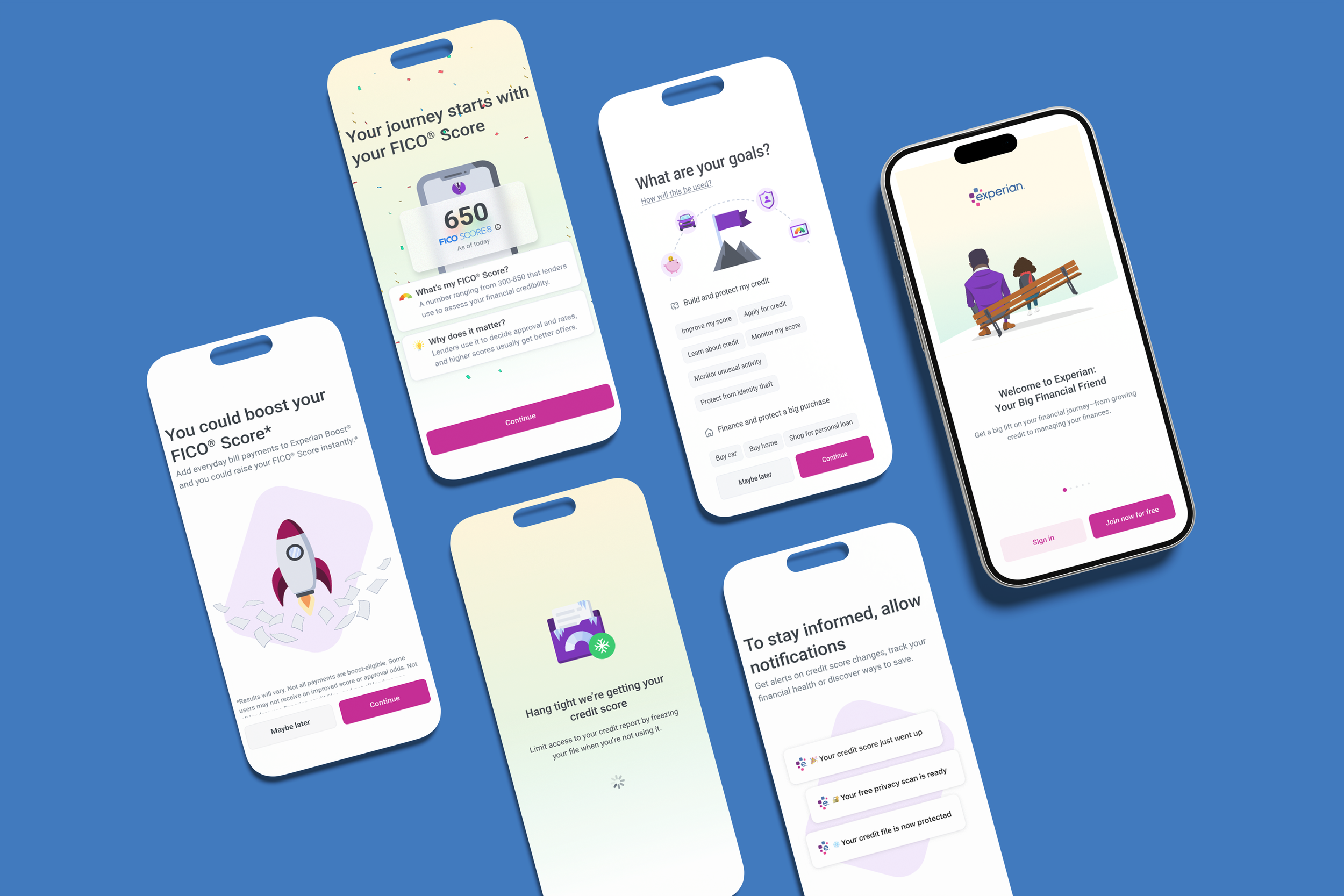

Our design goals were - match our external/communication branding, utilize our design system as thoroughly as possible, and utilize CMS to create a template-based solution that can be adapted to any one user’s goals and interests.

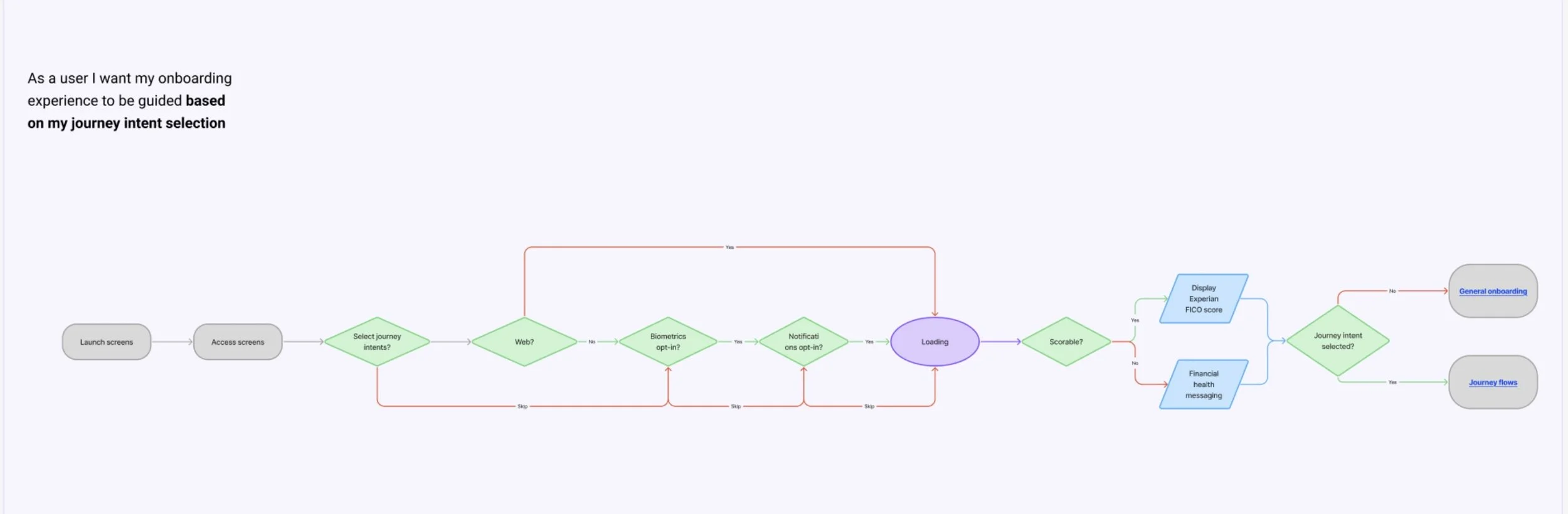

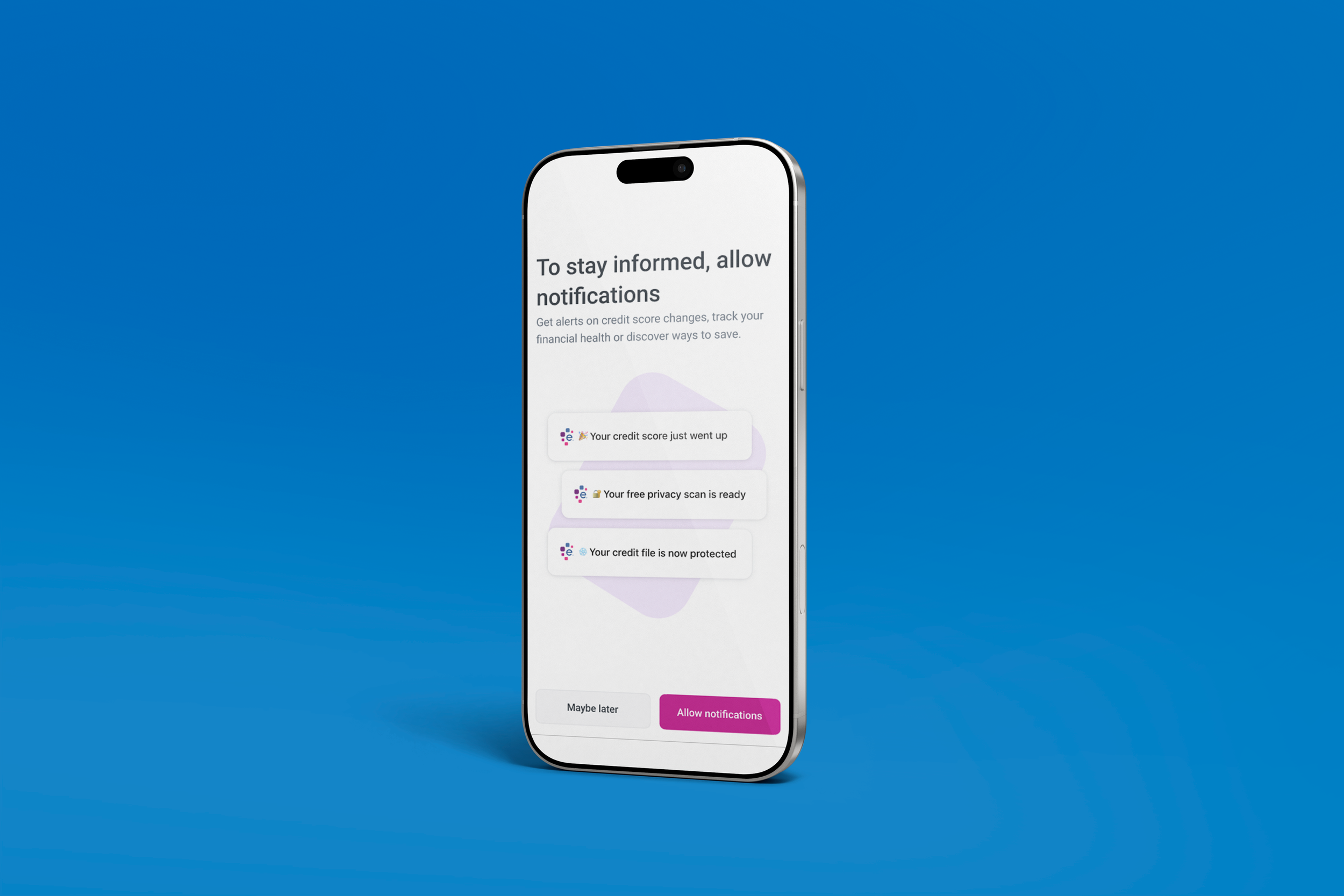

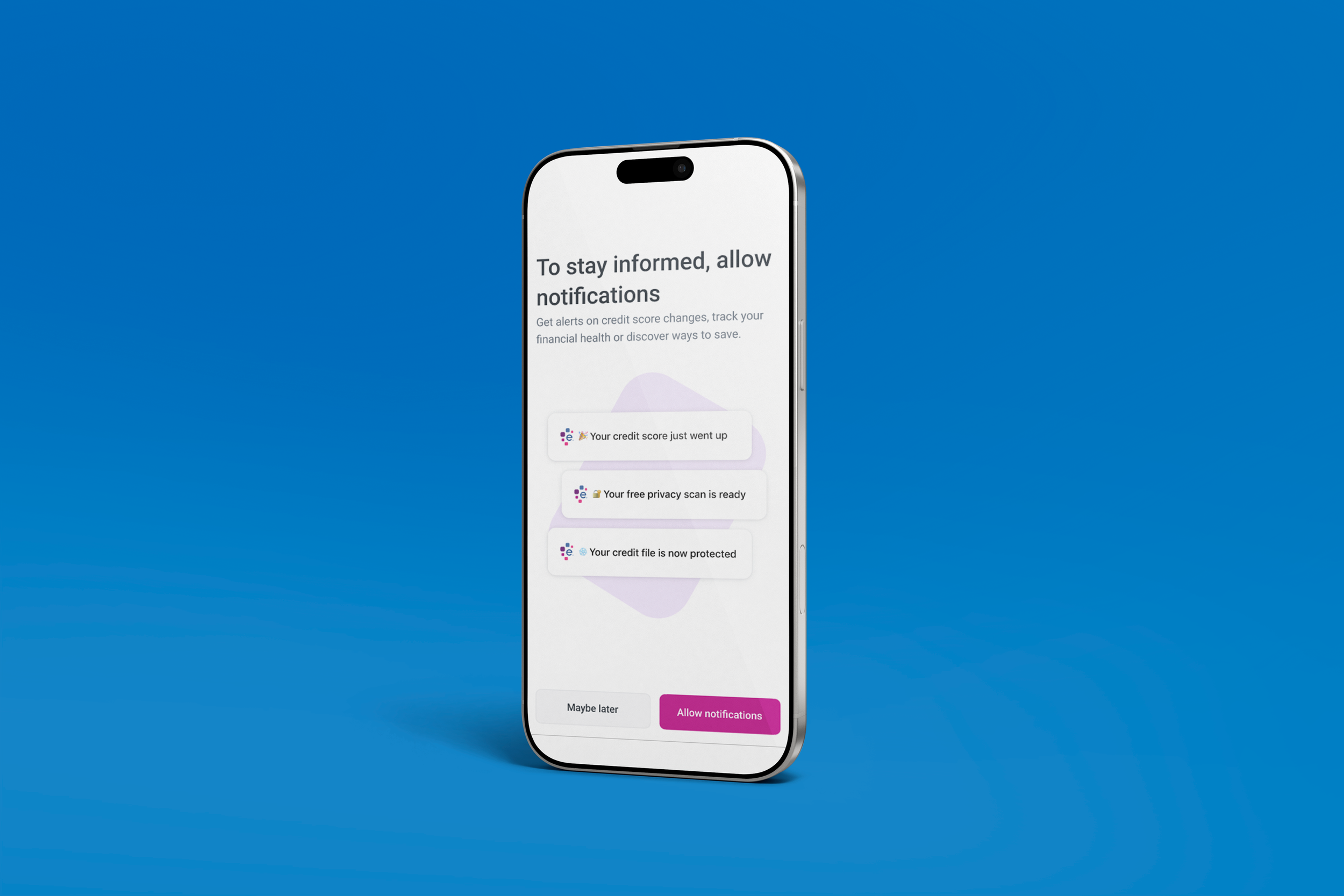

Our developers and CMS developers were involved in every step of the process–from helping us create and map content models for our templates, to improving the content and understandability of existing screens like opting into biometrics and allowing push notifications.

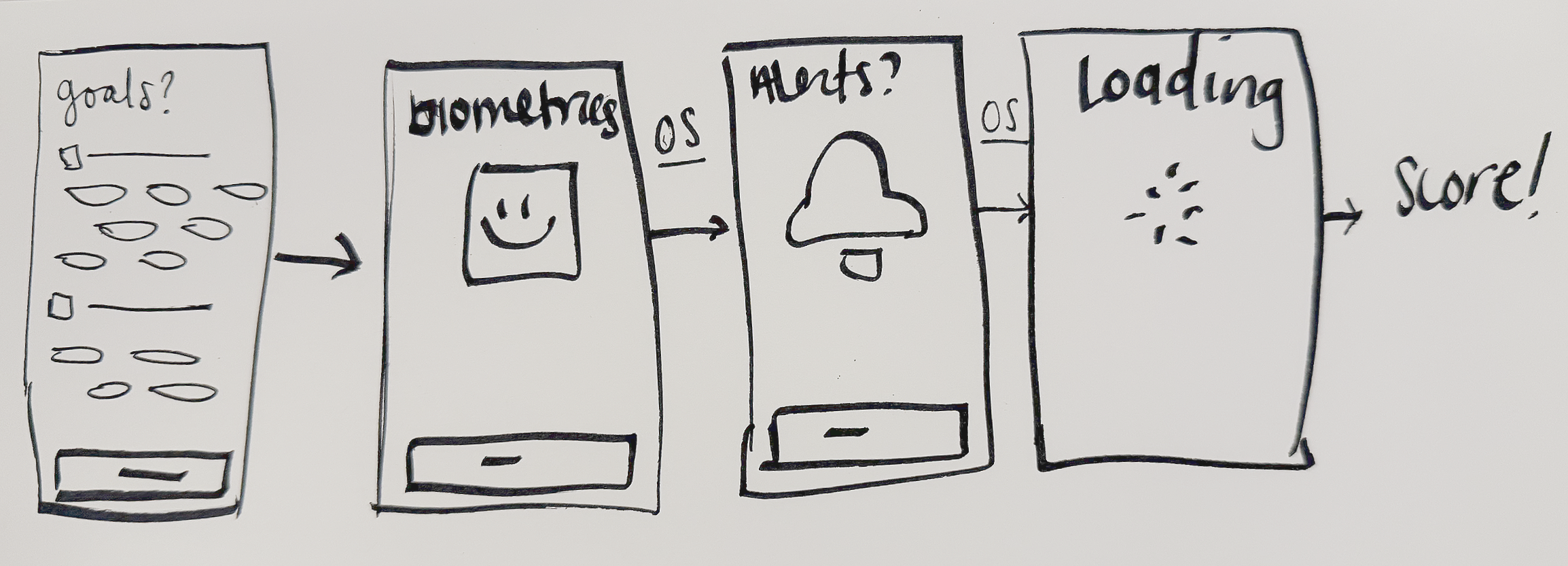

My designers mapped out all the onboarding flows, approved them with the product stakeholders, and worked with outside teams to ensure their features were mapped to the right users at the right time.

PERSONALIZED GOAL-DRIVEN ONBOARDING

DESIGN & REFINEMENT

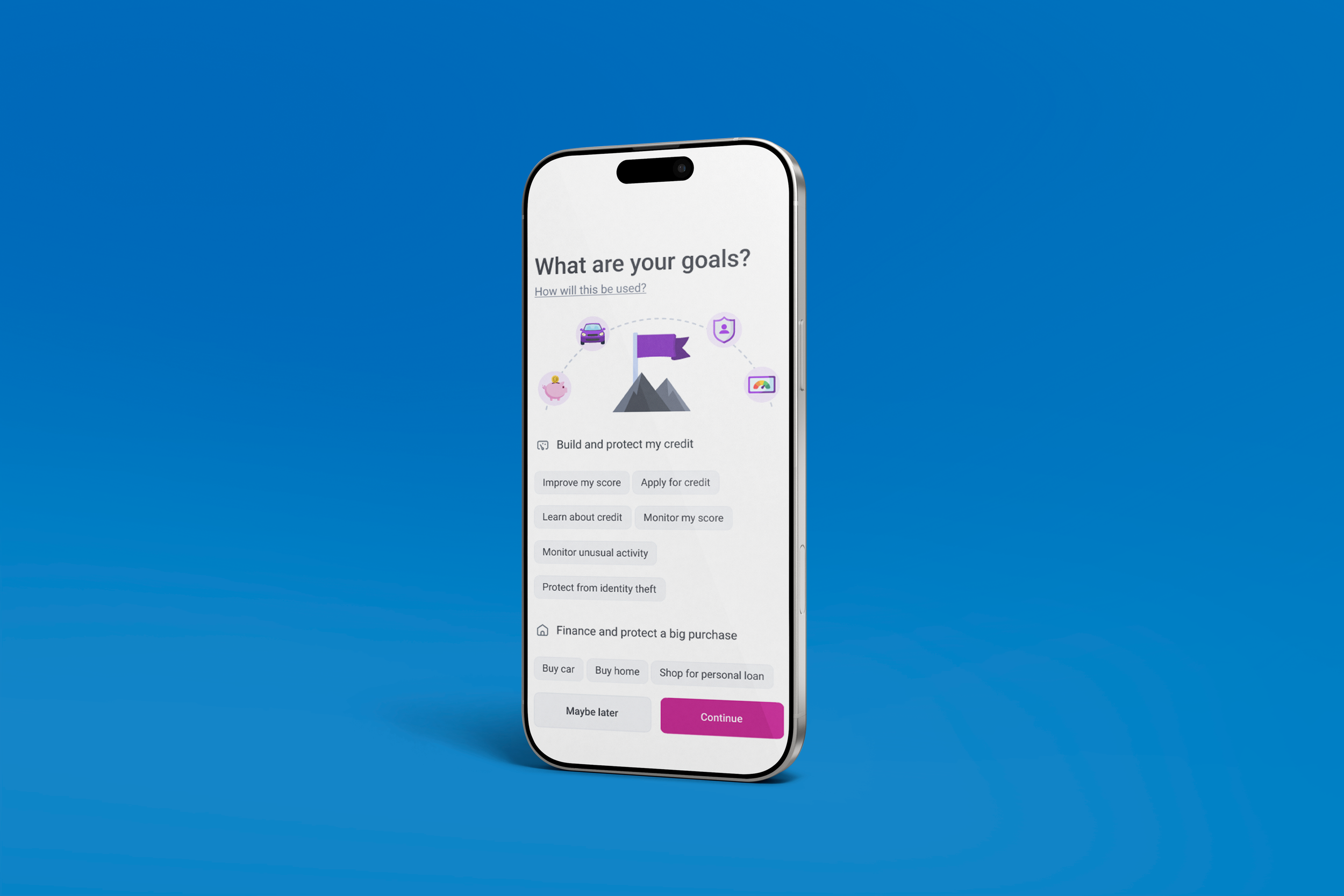

CRAFTING THE SOLUTION

How were user needs balanced with business goals?

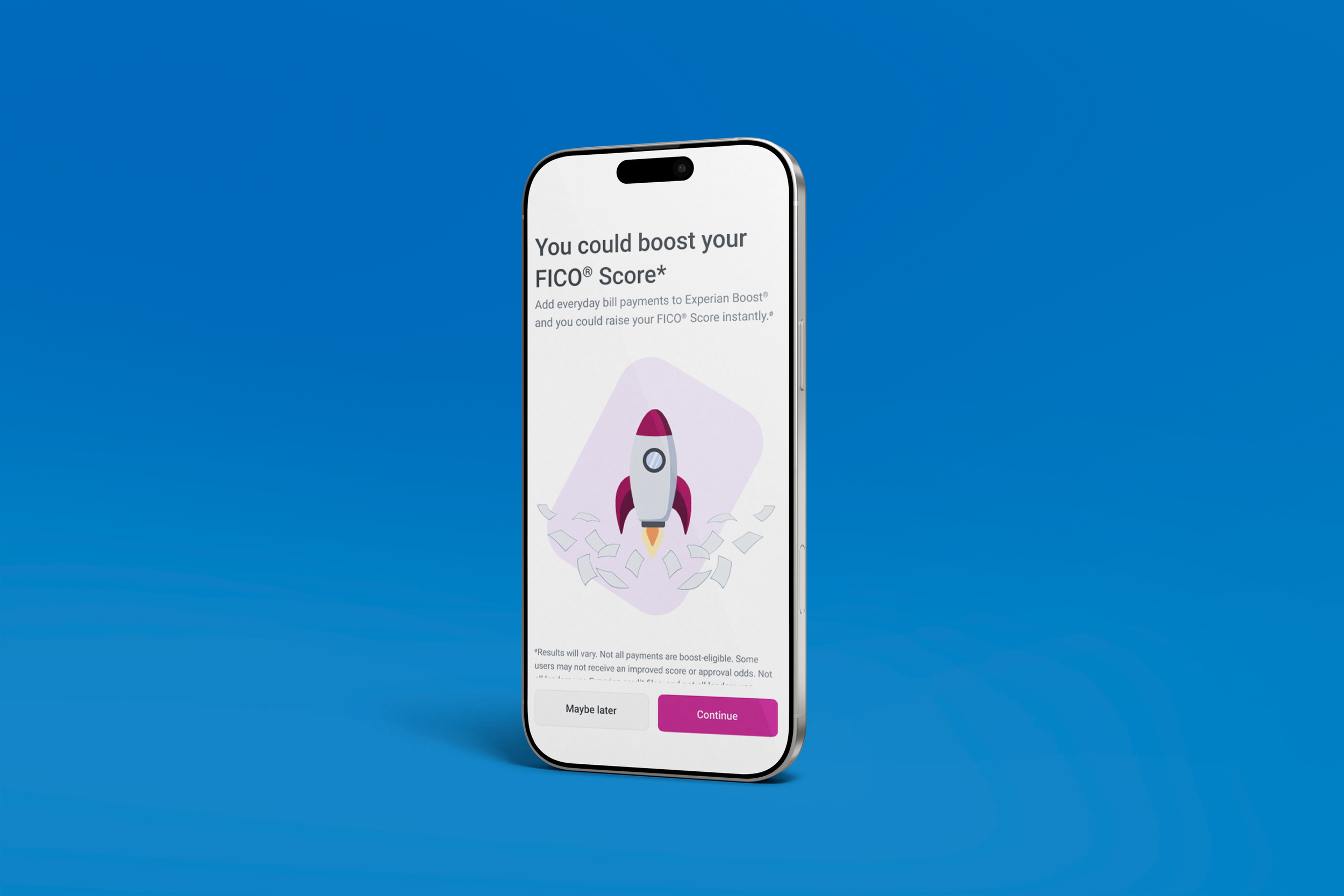

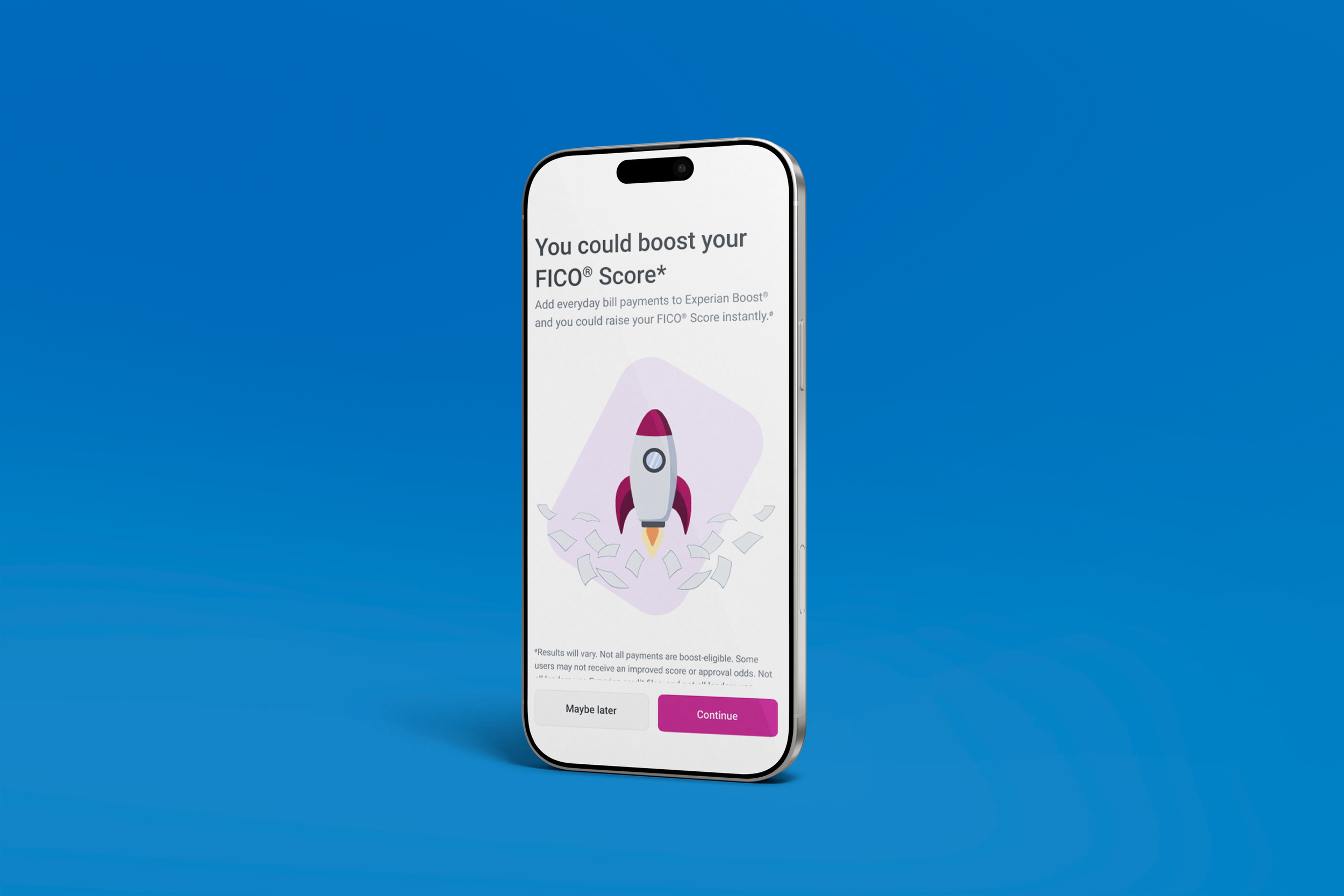

User onboarding is mostly about engagement, but it can’t impose on business goals. We ensured we could include high value tasks such as connecting their financial accounts or using our core features, like boost, in the onboarding directly.

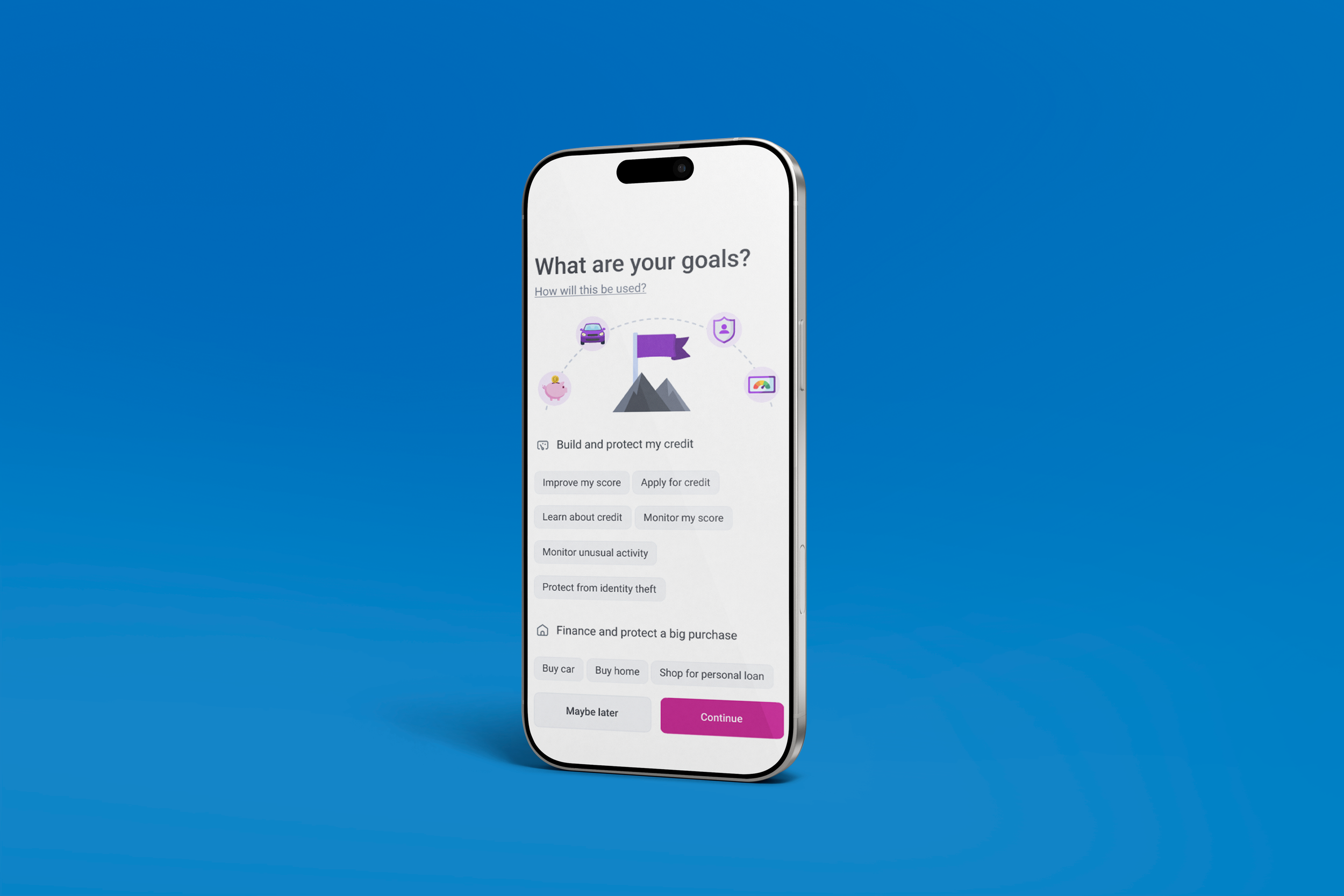

What were the key interactions or flows?

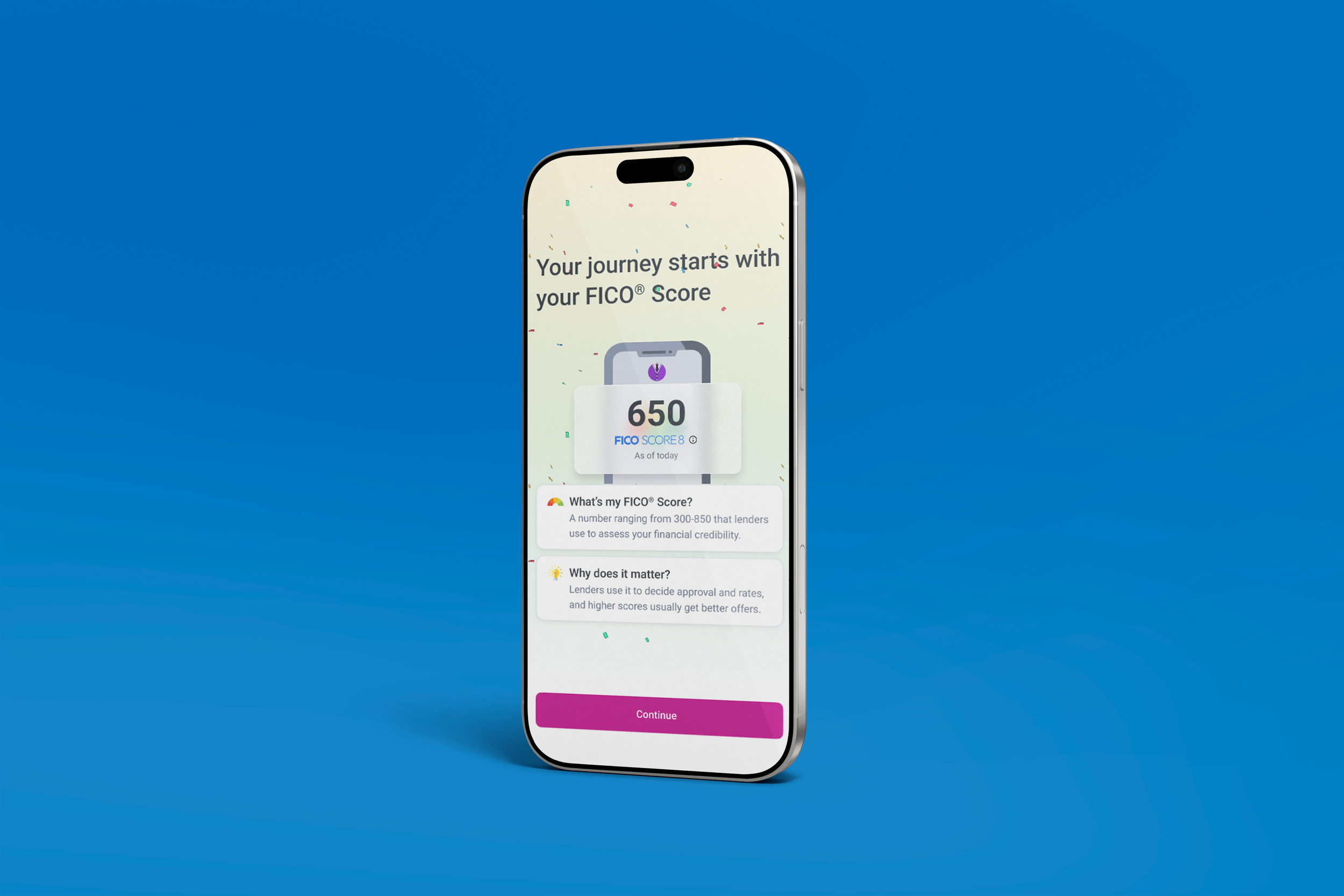

Letting users get immediate value by selecting their interests and goals, giving them their credit score, and next best steps up front upon account creation.

Asking for interests and goals also ensures we are appropriately targeting users with opportunities and upsells that relate to them personally.

TESTING & VALIDATION

PERSONALIZED GOAL-DRIVEN ONBOARDING

VALIDATING OUR APPROACH

Testing Method: Moderated usability testing

Learning Outcome: Although we worried our flow was too long, it was just the right amount of information to jump start the users and get them working toward their goals. User’s didn’t expect the extended onboarding, but they appreciated it.

Changes Made from Feedback: We are actively monitoring the flow in product and plan to make adjustments based on abandonment rates, drop off of tasks, and return log in frequency based on user goals. We plan to update this flow to allow users to rank their goals so we know what’s most important to them.

Measuring Success: Our success was measured via analytic events and tracking the revenue and engagement impacts of users who went through the new flow, vs those who did not.

TESTING RESULTS

Revenue per customer: Up 47%

Logins per customer: Up 4%

Upsell rate: Up 56%

Account connections: Up 25%

PERSONALIZED GOAL-DRIVEN ONBOARDING

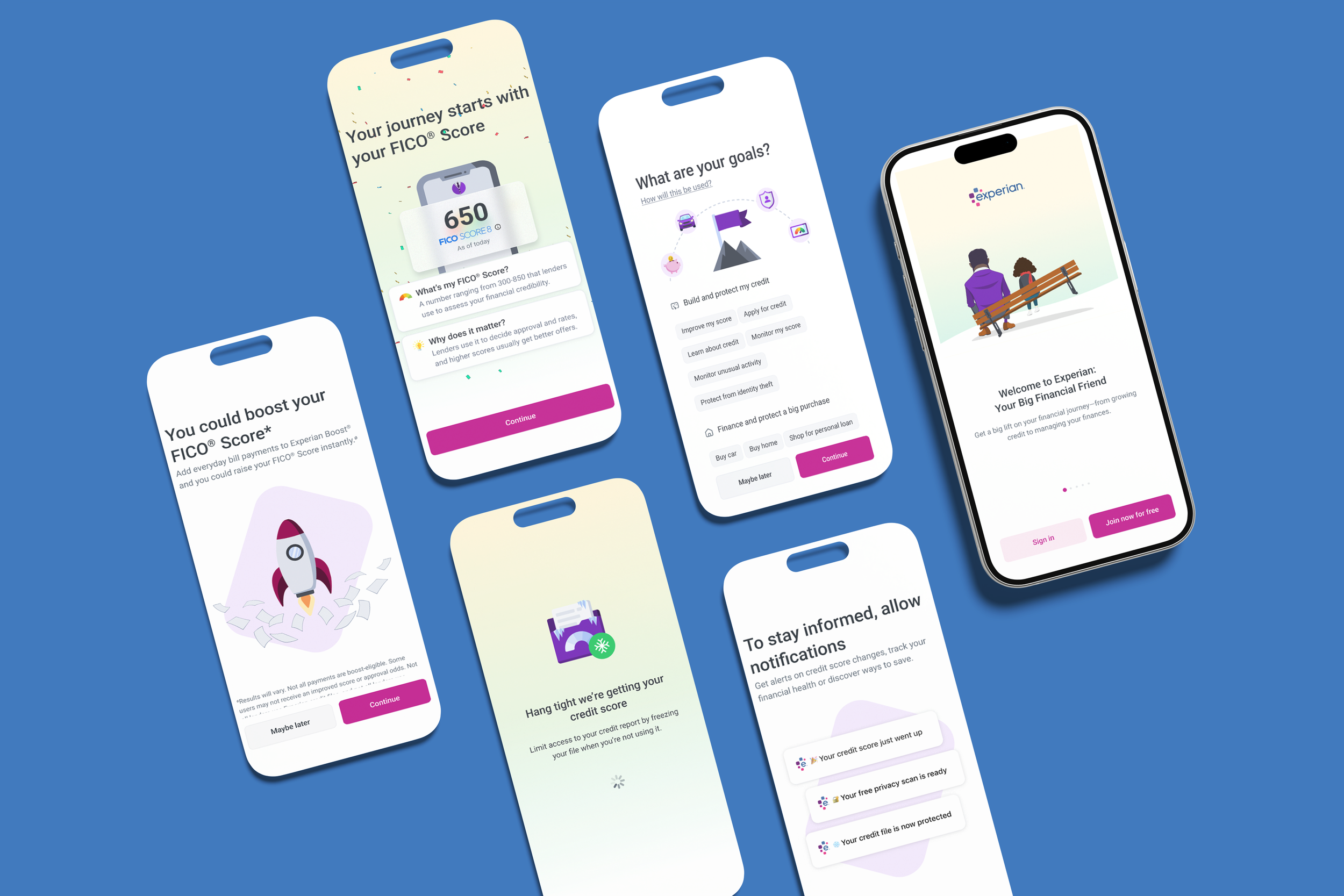

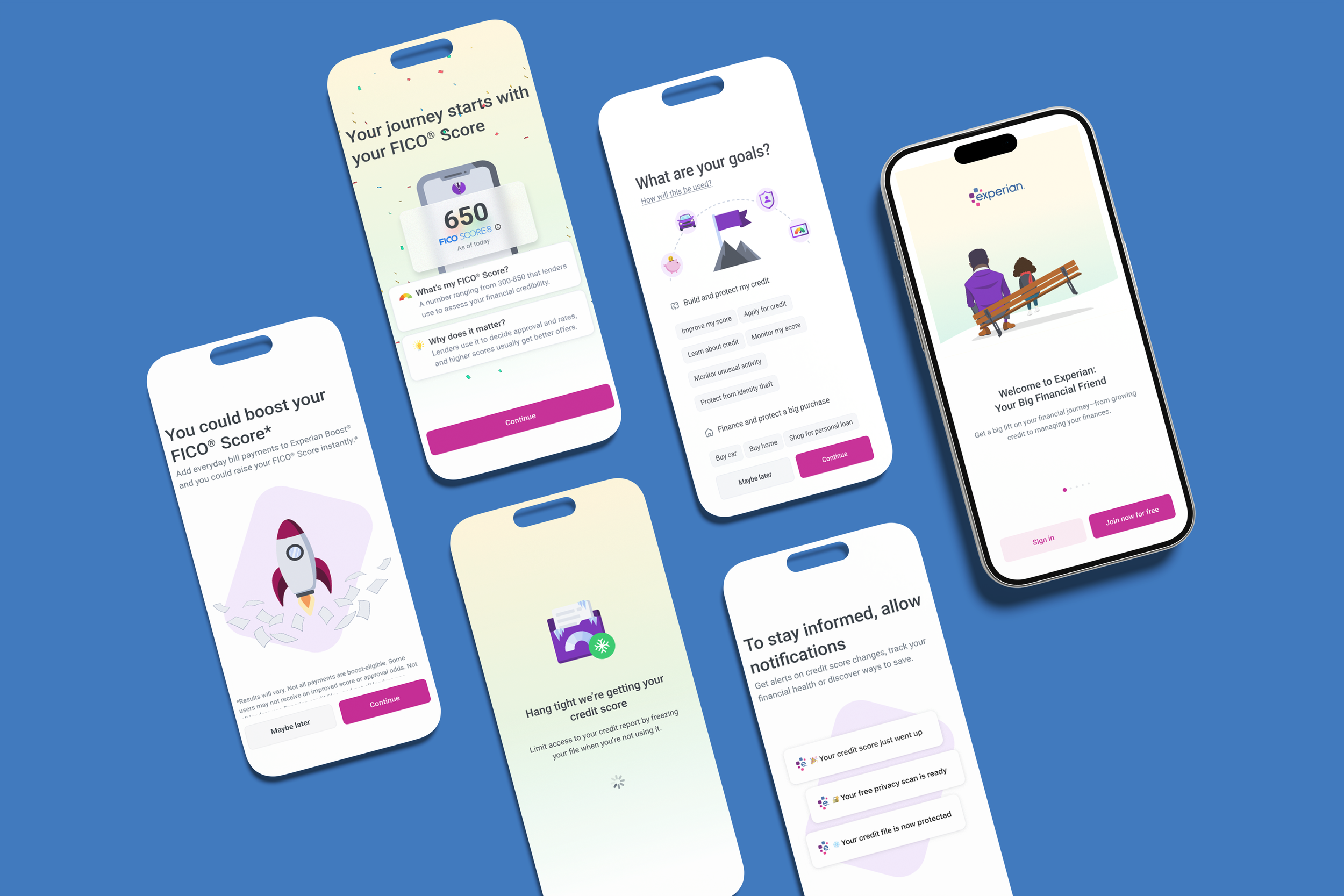

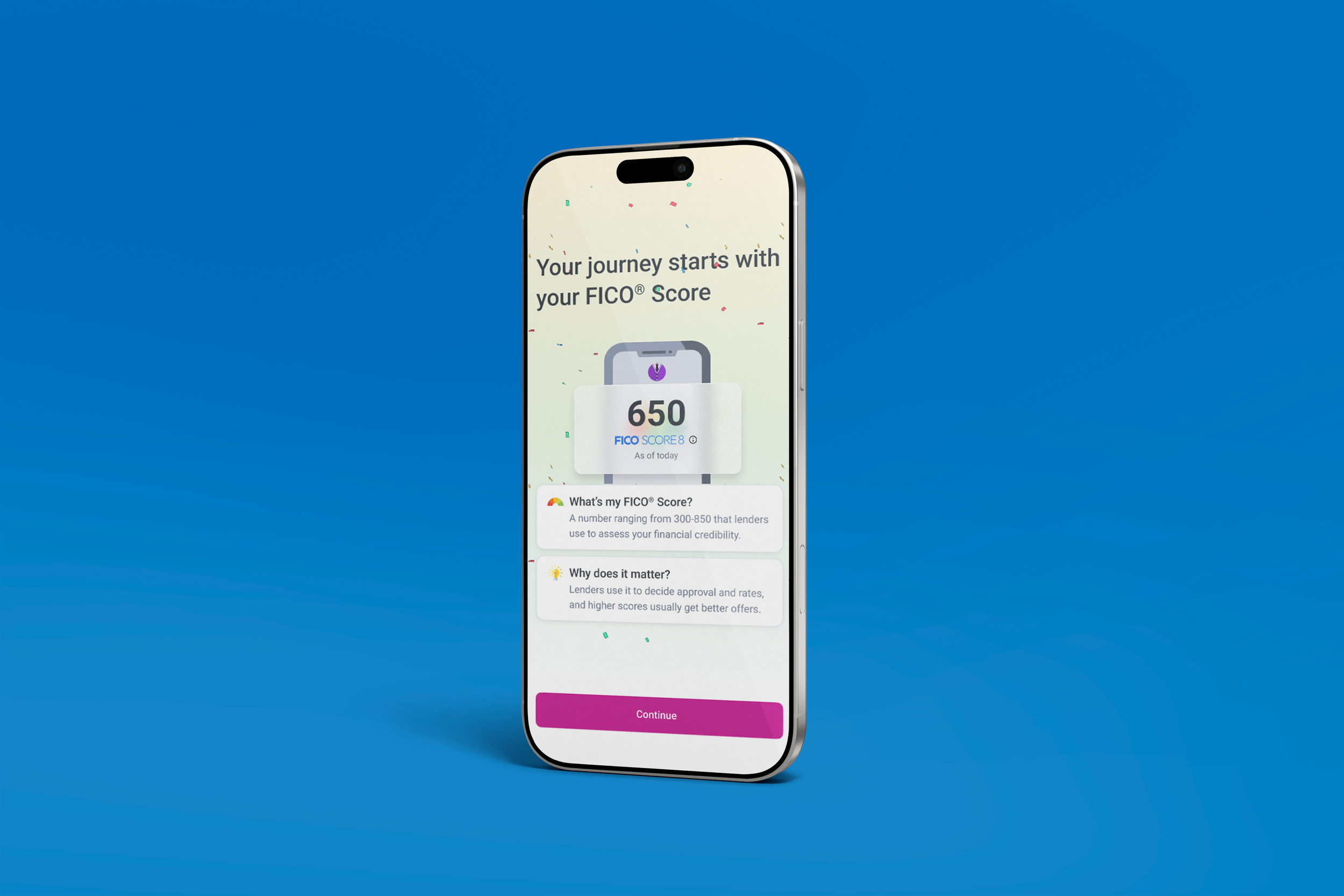

FINAL PRODUCT

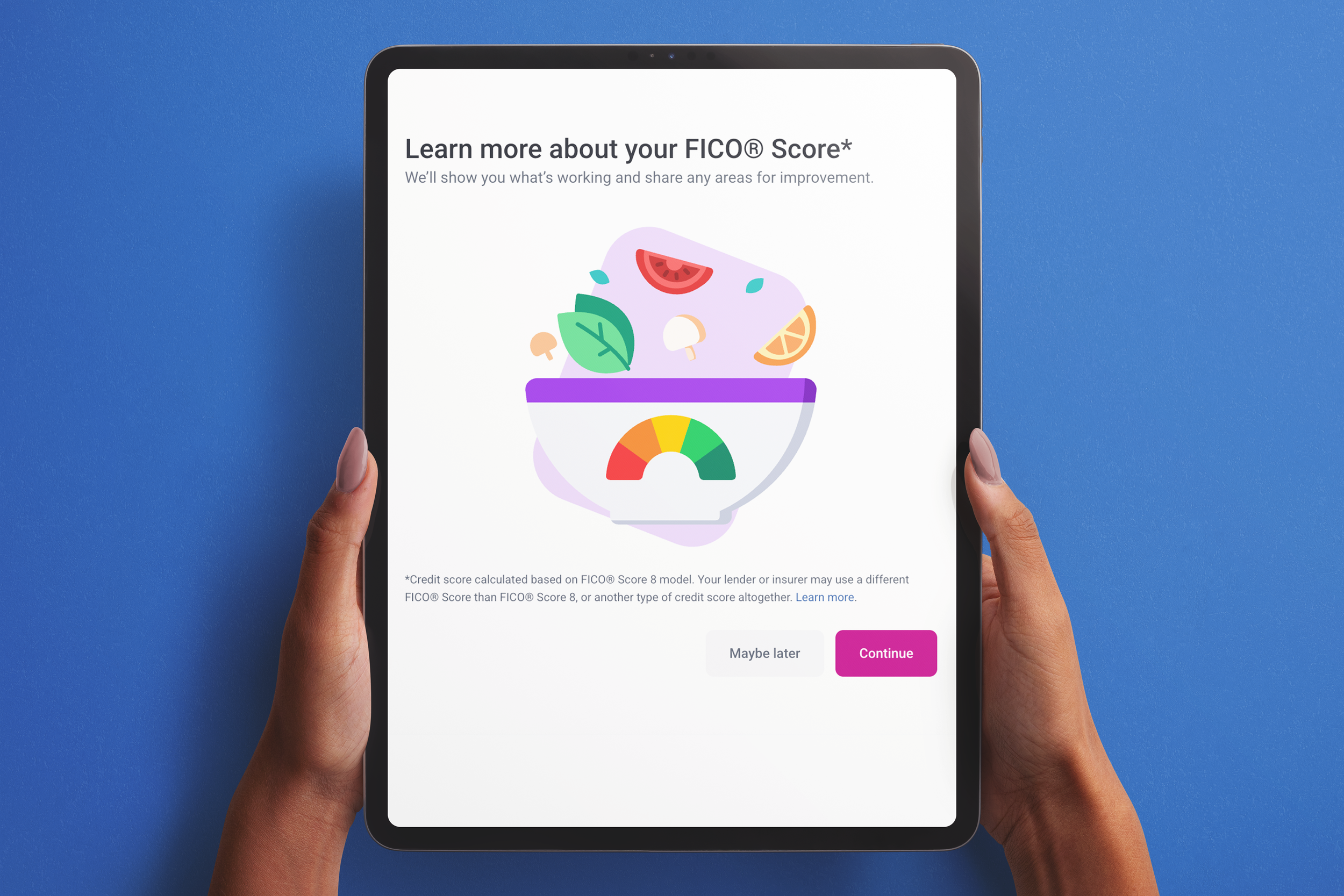

THE DELIVERED EXPERIENCE

Our final product enhances the existing flow features, provides a bit of joy with our unique illustration style, and gives the user an immediate next step to achieve their goals

Most importantly, we’re seeing greater return engagement from users who went through this flow when they signed up for an account.

Now, upon account creation, we know our user’s goals and interests, what they’re most focused on, and how to help them take meaningful steps toward financial progress.

Prototype demo of the entire flow

IMPACT & RESULTS

PERSONALIZED GOAL-DRIVEN ONBOARDING

MEASURING SUCCESS

Users are able to find value in their membership more quickly, but more importantly, its value is directly tied to the goals they expressed to us.

The metrics show a large increase in revenue and upsell volume per customer, compared to those who went through our pre-existing onboarding flow

We learned that although lengthy, an onboarding flow that sets you up for success is highly valuable for our business and our users.

50% increase in upsell rate for new users who signed up via this flow

Total revenue per customer increased

by 47%

33% increase in engagement of paid features

59% increase in monthly subscriptions per customer